Anand Mahindra in Awe of UPI-Supported ATM in Mumbai

Introduction

In a world driven by technological advancements and digital innovations, the financial sector has seen a radical transformation. Among the many developments that have reshaped the landscape of banking and financial services, the Unified Payments Interface (UPI) in India has emerged as a game-changer. Recently, Anand Mahindra, the Chairman of the Mahindra Group, expressed his awe and admiration for a UPI-supported ATM in Mumbai. This incident not only underscores the significance of UPI but also highlights the potential for further innovation in the financial sector.

The UPI Revolution

The National Payments Corporation of India (NPCI) developed the Unified Payments Interface (UPI), a real-time payment system. Launched in 2016, UPI allows users to instantly transfer money between banks using their smartphones. It has revolutionized the way Indians conduct financial transactions, making digital payments accessible to people across the socio-economic spectrum.

Anand Mahindra's Encounter

Anand Mahindra, known for his active presence on social media, shared his remarkable encounter with a UPI-supported ATM in Mumbai on Twitter. He described the experience as 'simply dazzling' and praised the seamless integration of technology into everyday banking. His post went viral, sparking a conversation about the future of banking and the role of UPI.

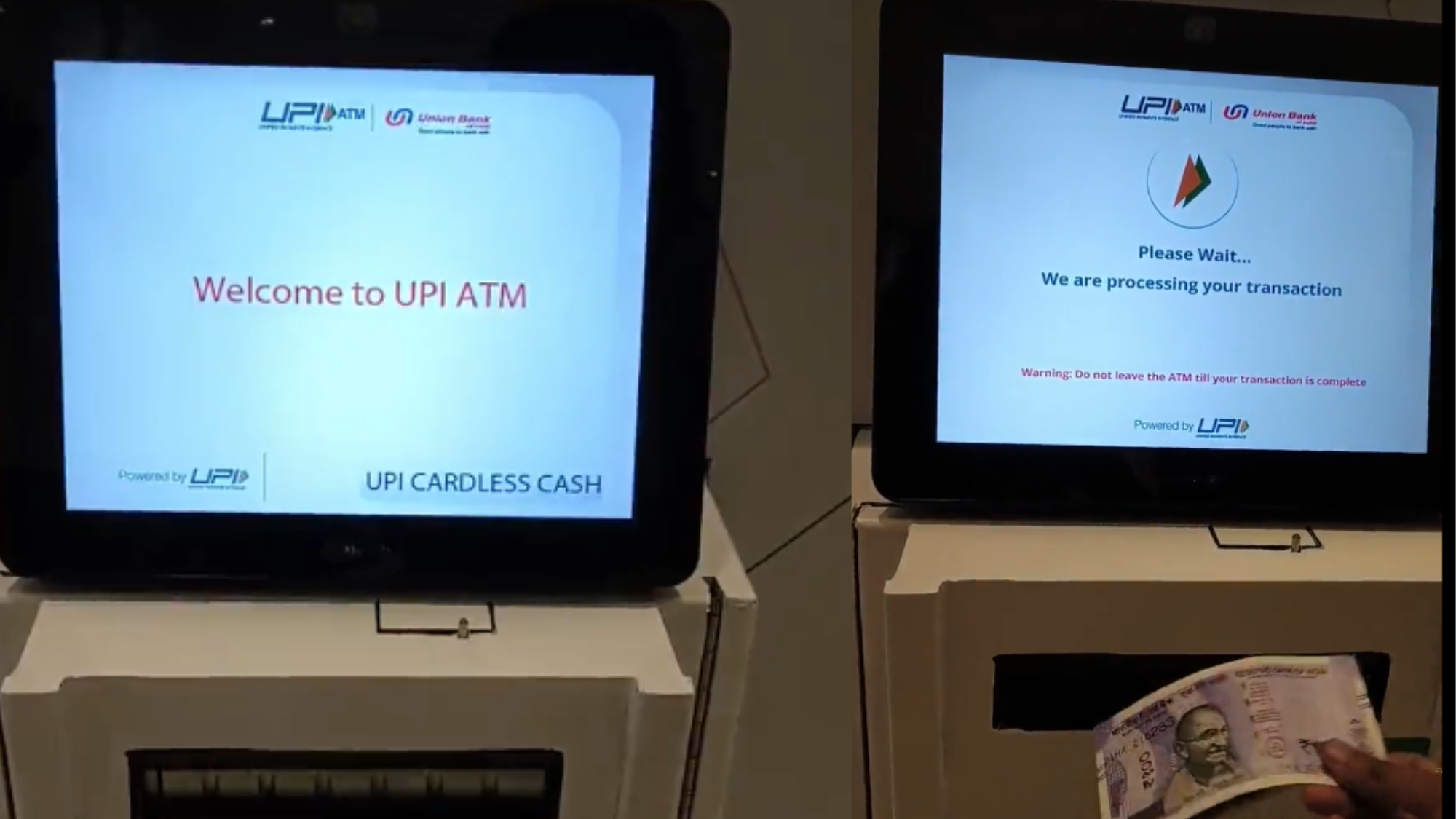

The UPI-Supported ATM

The UPI-supported ATM that left Anand Mahindra in awe is a prime example of how technology is enhancing convenience and efficiency in banking. Here are some key features of this innovative ATM:

1.Cashless Withdrawals: This ATM allows users to withdraw cash without using a traditional debit card or ATM card. Instead, customers can initiate a withdrawal using their UPI-linked mobile apps.

2.QR Code Integration: To withdraw cash, customers scan a QR code displayed on the ATM screen using their mobile banking app. This QR code contains all the necessary transaction details.

3.Secure Authentication: The transaction requires authentication through biometric verification or a PIN, ensuring that only authorized individuals can withdraw cash.

4.Instant Confirmation: Once the transaction is completed, users receive an instant confirmation on their mobile app, and the cash is dispensed from the ATM.

5.No Need for Physical Cards: This ATM eliminates the need for carrying physical cards, reducing the risk of card loss or theft.

6.24/7 Accessibility: Like traditional ATMs, UPI-supported ATMs are available 24/7, providing customers with round-the-clock access to their funds.

The Impact of UPI on Banking

The incident involving Anand Mahindra's encounter with the UPI-supported ATM highlights the broader impact of UPI on the banking industry:

1.Financial Inclusion: UPI has played a crucial role in bringing banking services to remote and underserved areas. With just a smartphone and an internet connection, people in rural India can now access a wide range of financial services.

2.Reduced Cash Dependency: UPI has contributed to reducing the dependency on physical cash, which has benefits such as lower cash-handling costs for banks and increased transparency in financial transactions.

3.Enhanced Security: The integration of biometric authentication and PINs in UPI transactions enhances security, making it more difficult for fraudulent activities to occur.

4.Boost to Digital Economy: UPI has been a catalyst for the growth of India's digital economy. It has facilitated e-commerce transactions, bill payments, and person-to-person transfers, stimulating economic activity.

5.Innovation in Banking: The incident involving the UPI-supported ATM demonstrates that banks and financial institutions are continually innovating to provide customers with more convenient and secure banking experiences.

The Road Ahead

As UPI continues to evolve and gain traction, the future of banking in India looks promising. However, there are challenges to address, including cybersecurity concerns, data privacy, and ensuring that all segments of society can access and benefit from digital financial services.

Moreover, innovation should not stop at UPI-supported ATMs. To develop even more effective and user-friendly solutions, banks and fintech companies must investigate cutting-edge technologies like blockchain, artificial intelligence, and machine learning. Additionally, initiatives should be taken to inform the public about the advantages and secure application of digital financial technologies.

Conclusion

Anand Mahindra's appreciation for the Mumbai UPI-supported ATM is proof of the financial industry's ability to be transformed by technology. UPI has democratized access to banking services, reduced cash dependency, and paved the way for innovative solutions like UPI-supported ATMs. As India's banking landscape continues to evolve, it is essential for stakeholders to collaborate and ensure that the financial system remains secure, inclusive, and customer-centric. The 'simply dazzling' future of banking awaits those who embrace and drive these technological advancements.