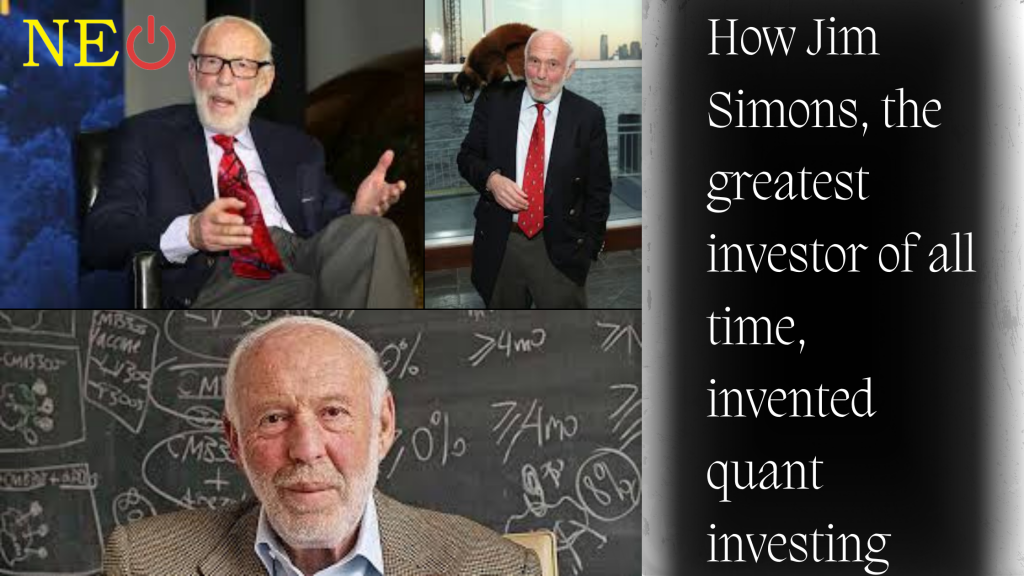

Within the realm of making an investment, few names evoke as much reverence and intrigue as that of Jim Simons. Frequently dubbed the "Quant King '' or the "world's Smartest Billionaire," Simons' adventure from a code-breaking mathematician to a pioneering investor is a testimony to his remarkable intellect, relentless interest, and modern spirit. via the utility of superior mathematical fashions, Simons revolutionized the funding landscape, earning him an area a few of the finest investors of all time.

Jim Simons' tale is certainly one of first-rate transformation. After receiving his Ph.D. in arithmetic from the University of California, Berkeley, Simons launched into a prominent educational profession that specialize in geometry and topology. His groundbreaking paintings in arithmetic earned him several accolades and established him as a main parent in his area. but, it was his foray into finance that would in the end catapult him to mythical repute.

In 1978, Simons founded Renaissance technologies, a quantitative current fund that might emerge as the cornerstone of his funding empire. Armed with a group of excellent mathematicians, scientists, and laptop programmers, Simons set out to use rigorous quantitative analysis to financial markets—a singular method on the time that might soon yield awesome effects.

On the coronary heart of Renaissance's success lies its state-of-the-art buying and selling strategies, pushed with the aid of complex mathematical algorithms and statistical models. Unlike traditional investors who depend upon instinct and subjective judgment, Renaissance's method is only information-pushed, leveraging massive amounts of historic marketplace statistics to discover styles and anomalies that can be exploited for profit.

Significant to Renaissance's method is the use of high-frequency trading and machine studying strategies to capitalize on fleeting marketplace inefficiencies. By means of hastily reading big datasets and executing trades with exceptional pace and precision, Renaissance is capable of generating outsized returns even as minimizing chance—a feat that has eluded many of Wall road's most pro buyers.

One of Renaissance's maximum iconic price ranges is the Medallion Fund, a secretive and especially distinctive funding vehicle that is widely regarded as one of the most successful modern-day price ranges in records. Given its inception, the Medallion Fund has added wonderful returns, always outperforming conventional benchmarks and rivaling the overall performance of some of the arena's pinnacle-appearing present day funds.

What sets the Medallion Fund apart is its uncanny capability to generate alpha—a measure of investment overall performance that displays the ability of the fund managers in identifying profitable possibilities. While many contemporary funds struggle to conquer the marketplace, not to mention consistently generate alpha, the Medallion Fund has completed this feat yr after yr, cementing its recognition as a true outlier in the world of finance.

Jim Simons' success as an investor is not merely made of his mathematical prowess, but also of his visionary leadership and unwavering commitment to excellence. Under his guidance, Renaissance technologies has remained at the leading edge of quantitative investing, usually pushing the limits of what is feasible within the world of finance.

Beyond his accomplishments in the monetary realm, Jim Simons' legacy extends a ways beyond the bottom line. Through his philanthropic endeavors, which includes the established order of the Simons foundation, he has made giant contributions to medical studies, schooling, and healthcare, leaving an indelible mark on society that transcends the sector of finance.

As we replicate the unheard of fulfillment of Jim Simons and Renaissance technology, we're reminded of the transformative strength of innovation and the long-lasting impact of visionary questioning. In an industry dominated by using way of life and convention, Simons dared to project the status quo, paving the way for a new generation of quantitative investing and reshaping the landscape of finance for generations to return. genuinely, his legacy because the "Quant King" will maintain to inspire and captivate buyers for years to come.