Is Bhutan giving duty-free gold ? Taxation and Cultural Significance

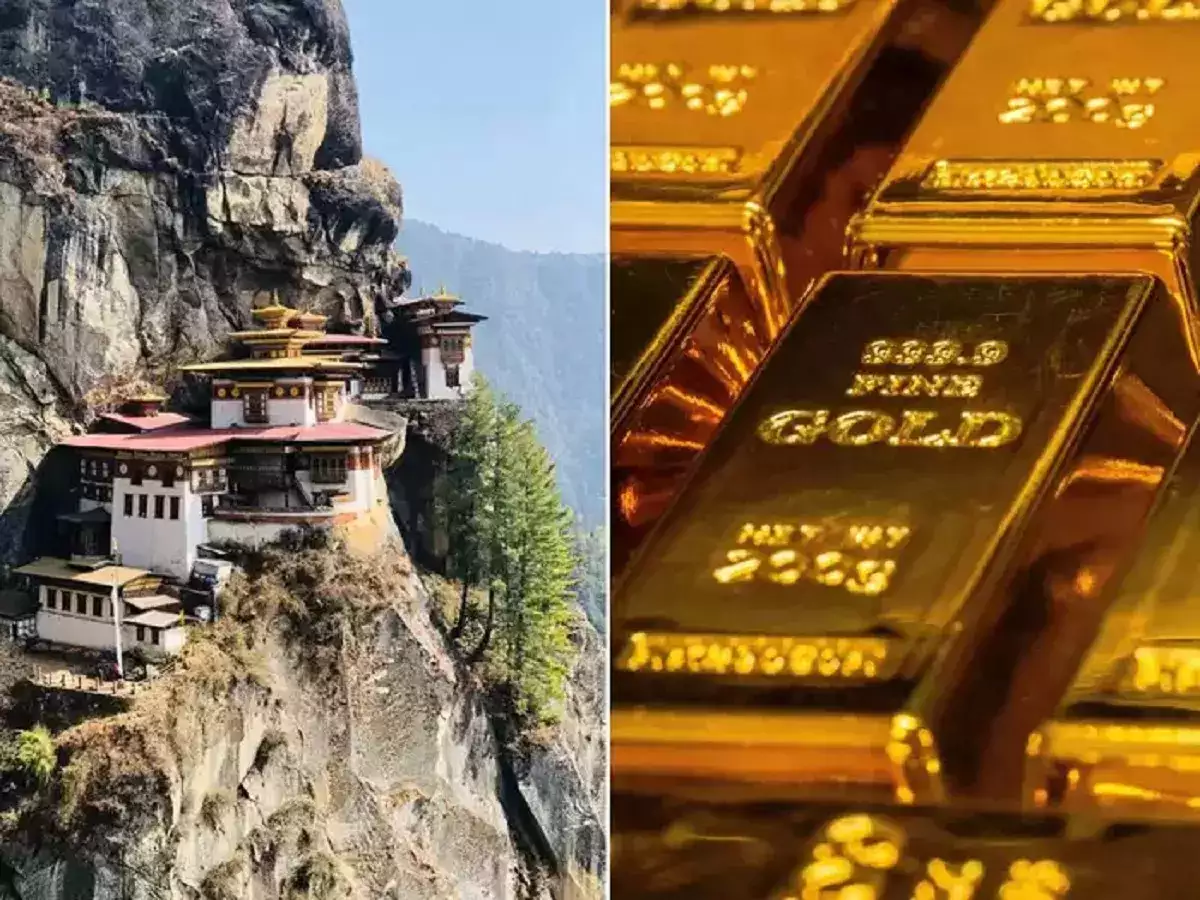

Gold holds a special place in Bhutan, a small landlocked kingdom nestled in the Himalayan mountains. Known for its pristine landscapes, rich culture, and unique governance philosophy of Gross National Happiness (GNH), Bhutan has a complex relationship with gold when it comes to taxation.

Cultural Significance of Gold in Bhutan

In Bhutan, gold is not just a precious metal; it carries deep cultural and religious significance. The Bhutanese people have a tradition of adorning themselves with gold jewelry, and gold plays a prominent role in religious ceremonies and rituals. Bhutanese wear gold necklaces, earrings, bracelets, and rings not just as a display of wealth but as a symbol of cultural identity and spiritual devotion.

One of the most iconic representations of gold in Bhutan is the Golden Roofed Temple in the Punakha Dzong, a stunning example of Bhutanese architecture. The golden roof of this temple glistens in the sunlight, making it a symbol of Bhutan's spiritual and cultural heritage.

Gold Taxation in Bhutan

Bhutan's tax system is unique and reflects its commitment to GNH, which emphasizes the overall well-being of its citizens over material wealth. Bhutan does not have a wealth tax or a specific tax on gold. This does not imply that gold is totally tax-free in Bhutan, though.

While there is no direct tax on gold, it is essential to understand that Bhutan has a Value Added Tax (VAT) system, known as the Bhutan Sales Tax (BST). The sale of goods and services, including gold jewelry, is subject to this tax. The BST rate can vary, but it is generally set at 5% of the transaction value. Therefore, when purchasing gold jewelry in Bhutan, customers are subject to this indirect tax.

Import of Gold in Bhutan

Bhutan's approach to gold taxation also extends to the import of gold. The government regulates the import of gold to ensure that it aligns with the country's goals of promoting cultural values and preventing excessive wealth accumulation. Importing gold into Bhutan is subject to customs duties and import taxes. These import taxes can vary depending on the type and quantity of gold being brought into the country.

The Bhutanese government has implemented these measures to strike a balance between preserving cultural traditions and preventing the hoarding of gold as a form of investment, which could potentially distort the nation's values of GNH.

Gold Smuggling and Illicit Trade

Due to the restrictions on gold imports and the cultural significance of gold in Bhutan, there have been concerns about gold smuggling and illicit trade. Smugglers often try to bring gold into Bhutan through various means to evade taxes and regulations. The illegal gold trade threatens the nation's ability to collect taxes and preserve its cultural legacy, so the government has taken action to stop it.

The Role of Gold in Bhutan's Economy

While gold is not a significant contributor to Bhutan's economy compared to sectors like agriculture and tourism, it plays a vital role in preserving cultural traditions and values. The government's approach to gold taxation is a reflection of its commitment to balancing economic development with the preservation of Bhutan's unique cultural identity.

Conclusion

In Bhutan, gold is more than just a precious metal; it is a symbol of cultural heritage and religious devotion. While there is no direct tax on gold, Bhutan has implemented a Value Added Tax (BST) on the sale of gold jewelry, and there are import taxes on gold to regulate its flow into the country. These measures are in line with Bhutan's philosophy of Gross National Happiness (GNH), which prioritizes well-being over material wealth. The unique approach to gold taxation in Bhutan serves as a reminder of the country's commitment to preserving its rich cultural traditions while pursuing economic development.

An Indian man is permitted to import gold worth Rs 50,000 and an Indian woman is permitted to import gold worth Rs 1 lakh tax-free into India from overseas, under the regulations of the Central Board of Indirect Taxes and Customs.